Bitcoin On-Chain Data Suggests Current Price Range Is a Buy

Bitcoin on-chain data suggests that the current price range could be a good opportunity to buy Bitcoin. Long-term holders are accumulating

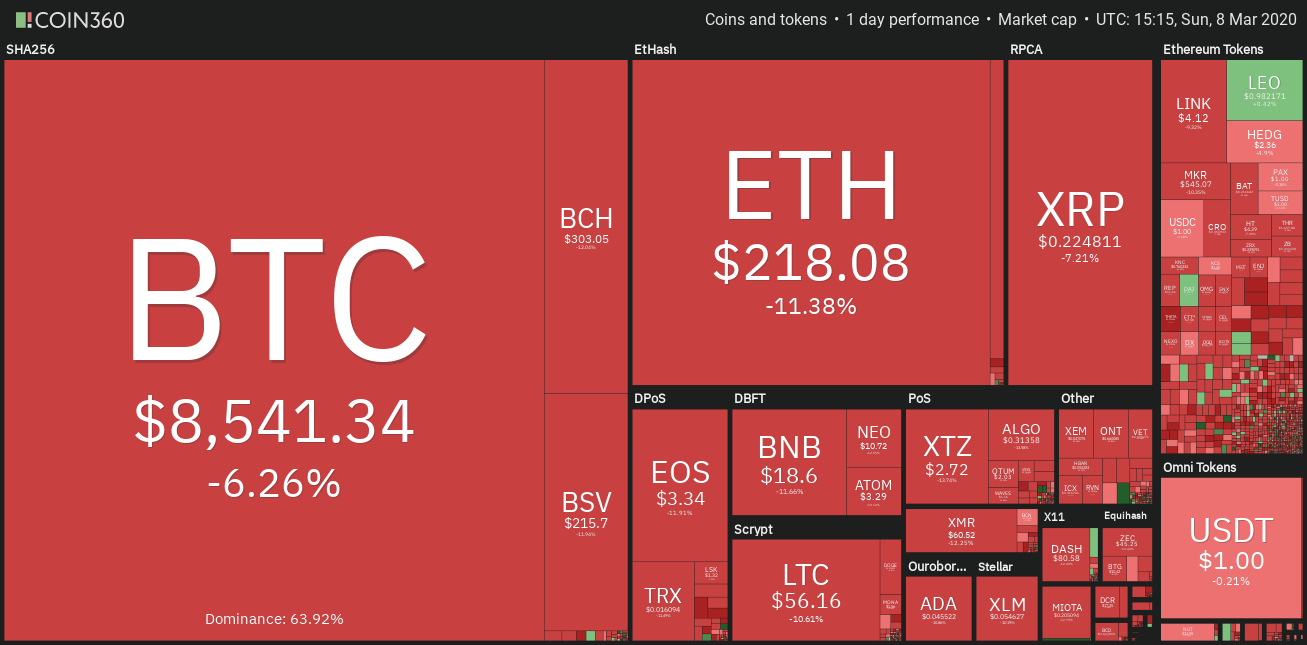

Bitcoin's price has been relatively flat in recent months, trading in a range of around $8,000 to $9,000. While this may be frustrating for some investors, it could also be a sign that a breakout is imminent.

Bitcoin On-Chain Data, which is data that is derived from the?Bitcoin blockchain, suggests that the current price range could be a good opportunity to buy Bitcoin. Here are a few reasons why:

Long-term holders are accumulating

Long-term holders of Bitcoin are those who have held their coins for more than 155 days. These investors are typically seen as the most bullish on Bitcoin and are unlikely to sell their coins at a loss.

According to data from Glassnode, long-term holders have been accumulating Bitcoin at a steady pace in recent months. This suggests that they believe that the current price range is a good value and that Bitcoin is poised for higher prices in the future.

Coin dormancy is increasing

Coin dormancy is a measure of how long Bitcoin coins have been sitting idle. When coin dormancy is increasing, it means that fewer coins are being spent and more coins are being held for the long term.

Data from Glassnode shows that coin dormancy has been increasing steadily in recent months. This suggests that there is a growing number of investors who are holding Bitcoin for the long term and are not interested in selling at the current price range.

Whales are accumulating

Whales are Bitcoin addresses that hold more than 1,000 BTC. These investors have a significant impact on the Bitcoin market and their buying and selling activity can move the price of Bitcoin.

According to data from Whalemap, whales have been accumulating Bitcoin in recent months. This suggests that they believe that the current price range is a good value and that Bitcoin is poised for higher prices in the future.

Technical analysis shows that Bitcoin is oversold

Technical analysis is the study of past price movements in order to predict future price movements. While technical analysis is not a perfect science, it can be a useful tool for identifying potential buying and selling opportunities.

According to technical analysis, Bitcoin is currently oversold. This means that the price of Bitcoin has fallen below its intrinsic value and is likely to rebound in the near future.

Based on the on-chain data and technical analysis, it appears that the current price range could be a good opportunity to buy Bitcoin. Long-term holders are accumulating, coin dormancy is increasing, whales are accumulating, and Bitcoin is technically oversold.

However, it is important to note that no investment is guaranteed and there is always the risk of loss. Investors should always do their own research before making any investment decisions.

Additional tips for buying Bitcoin

If you are considering buying Bitcoin, here are a few additional tips to keep in mind:

- Only invest what you can afford to lose. Bitcoin is a volatile asset and its price can fluctuate wildly.

- Buy from a reputable exchange. There are many different Bitcoin exchanges out there, so be sure to do your research before choosing one.

- Store your Bitcoin in a secure wallet. Once you have bought Bitcoin, you need to store it in a secure wallet. There are many different types of wallets available, so be sure to choose one that is right for you.

- Be patient. Bitcoin is a long-term investment. Don't expect to get rich quick.

Bitcoin on-chain data suggests that the current price range could be a good opportunity to buy Bitcoin. Long-term holders are accumulating, coin dormancy is increasing, whales are accumulating, and Bitcoin is technically oversold.

If you are considering buying Bitcoin, be sure to only invest what you can afford to lose, buy from a reputable exchange, store your Bitcoin in a secure wallet, and be patient.

What's Your Reaction?